UNREALISTICALLY LOW ESTIMATES FOR COMMUNITY AND DISTRIBUTED SOLAR

The oddest and most bewildering problem with Xcel’s revised 2020-2034 Integrated Resource Plan is that it presents a dubiously low estimate for future new Community, Distributed and Rooftop Solar.

In 2019, I noticed a forecast for new non-utility owned community and distributed solar that declined by 90% from current levels despite recent growth trends and an abundance of projects still in the queue.

This points toward a pattern. Xcel also lowballed estimates for Community Solar back in 2013 shortly after the State Law requiring them of Xcel was passed. The company anticipated it to be a much smaller boutique program for a niche customer base who was willing to pay a bit extra.

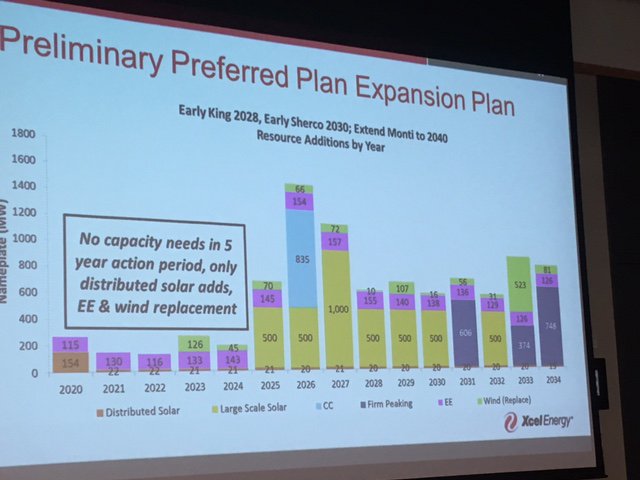

On May 20th of 2019, about the same time as their coal plant retirement announcement, I attended one of Xcel’s Stakeholder sessions. I took a photo where they had estimated 154 MW of distributed and Community Solar and then it suddenly dropped to 22 MW for 2021.

I then saw that Xcel’s revised 2020-2034 Integrated Resource Plan forecasts only about 21 or 22 MegaWatts per year of new Distributed/ Rooftop & Community Solar from 2021 through 2034. When I do the math, that amounts to only about 273 MW total in that timeframe.

For comparison, we had more than 200 MW, maybe as much as 250 MW of distributed and community solar added in 2018 alone.

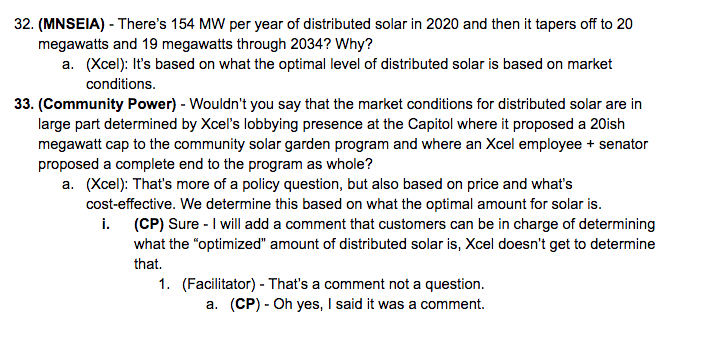

When a question was asked at Xcel’s May 20th, 2019 stakeholder meeting when the image was right in front of everyone, one company spokesperson tried to explain this steep drop-off in new distributed and community solar was due to “market conditions”.

The exchange is captured on a tweet at https://twitter.com/MplsEnergyOpts/status/1130946604540809218/photo/1

But market conditions are a dubious explanation because a government regulated monopoly that uses trade secrets that shelter some of their assumptions is quite contrary to the classical idea of how markets work.

Perhaps this drop-off is an admission that Xcel wants to see legislative action to curtail the Community Solar program but does not want to publicly admit that motive because it would be contrary to their marketing and advertising. But why craft an IPR around an apparent assumption that the State will cap the Community Solar program and end new projects?

Another possible but still not credible explanation is that Xcel expects that the value of solar will continue to fall. That would cause community solar subscribers to pay a huge premium to participate thus disincentivizing new community solar projects from being built without a legislative cap. But the decline in the Value of Solar figure from 2015 to 2019 was largely due to falling gas prices, which seem unlikely to fall much further.

Neither market conditions nor available capacity on Xcel’s system overall could explain why their forecast for community solar assumes such a dramatic drop.

There may be a number of comments coming in about how the Xcel plans to see current momentum will be quashed by about 90% in coming years. If other commentators are mistaken that Xcel is planning to cut back by 90% then the company really should not have posted the above chart at their stakeholder engagement meeting, knowing that it would provoke a sense of alarm among stakeholders.

I saw Xcel came up with more realistic estimates on Pages 128-29 of the supplemental filing they released on June 30th, 2020 though it was a bit odd that their High Distributed Generation model mixes together rooftop solar and community solar into one bucket. But even this scenario is only assuming about 500MW more of distributed solar between now and 2034 (as compared to over 800MW that have been built in the last 5 years). Xcel's current "High Distributed Solar" scenario still shows only about half as much distributed solar development as other independent studies have estimated, and also given that community solar gardens are currently coming online at between 100MW-200MW per year, Xcel is still low-balling the estimates.

Given-

1) the recent growth trends for non-utility owned solar,

2) that 2013 State Law obligates Xcel to accept new Community Solar project proposals and can’t turn it away, and

3) the sheer number of new Community Solar projects are already in the existing queue,

- we can realistically expect that new Community Solar added to Xcel’s system will still outstrip what Xcel estimates in their current IRP. Using a separate study by the National Renewable Energy Laboratory, the Institute for Local Self-Reliance found Xcel's forecasts for newly adopted rooftop solar to be anywhere from 249-460 MW less than their study, depending on the comparison models. https://ilsr.org/report-utility-distributed-energy-forecasts-2020/

THE INCENTIVES THAT GUIDE UTILITIES REFUSING TO CONSIDER THE VALUE OF DISTRIBUTED RENEWABLES

Perhaps the truth that formal company spokespeople do not want to publicly admit is a common denominator between these lowballed forecasts and their reluctance to study/ model a no-Sherco gas plant scenario.

The company does not want to present to the Public Utilities Commission any possible energy future scenarios that would reduce the utility’s need to spend capital in ways which offer their most reliable route to earning a profit. Utilities in general, not just Xcel, get the most profit by expending more capital on utility-owned infrastructure such as the proposed Sherco gas plant. Utility shareholders are guaranteed by law and the decades-old regulatory compact to get profits on these investments. You and I pay for these expenses on our monthly utility bills.

In other words, Xcel is almost certainly getting these distributed and community solar forecasts wrong because it has a built-in incentive to get it wrong.

The same pattern continues with an article I saw titled “Regulators, clean energy advocates want more details on Xcel’s demand response plans” in Midwest Energy News by Frank Jossi. https://energynews.us/2020/10/12/midwest/regulators-clean-energy-advocates-want-more-details-on-xcels-demand-response-plans/ High levels of demand response would substantially undermine Xcel’s logic for building the Sherco gas plant since it creates non-generation resources that can balance out variable renewable generation. Improved demand-side management would also reduce energy storage requirements. Since building new infrastructure is the primary way Xcel boosts its profits (via a margin on capital investments made), anything that reduces the need for Xcel to build more Xcel-owned infrastructure could easily be seen as undesirable to them.

There are real consequences to the PUC acting upon these lowballed estimates.

Lowballing customer-sited and non-utility solar energy and putting it in this IRP would have significant financial and economic consequences. It will leave the utility unprepared for grid impact of what is likely to be far more a significant deployment of distributed and/ or community solar than we are seeing today. Electric Utilities would instead be wiser to instead plan for more competition than craft a plan around an assumption that competition will be quashed by some mysterious reason their spokespeople will not publicly admit to.

The second big consequence of acting upon these lowballed estimates is that the utility will make investments in unneeded power generation which customers are obligated to cover the cost of, such as the proposed gas plant in Becker, MN.

Such poor planning, if actually instituted, could end up hurting the financial viability of the Xcel in the long term if it results in resource acquisitions that the company will not be able to recover costs from.

In order to continue making the case, I must share at least a few of the many forms how distributed renewable energy creates value. It

1) leads to lower energy costs & customer energy bill savings by offsetting utility capital expenditures on system upgrades or expansion,

2) prevents pollution and environmental externalities,

3) provides greater resiliency in the electricity system.

4) has less voltage loss than the standard method of transmitting bulk power from remote sites to distant loads.

Despite these benefits that distributed energy resources can bring into their system, utility companies in general, not just Xcel, often overlook the value in the crafting of Integrated Resource Plans. The reason is Utility investors can’t profit from distributed renewables in the same way they can profit from building new fossil gas power plants that are owned or put out for bid by the incumbent utility (or the long-distance transmission needed to connect it to consumers). This is why Xcel’s IRP shows a strong preference for new solar capacity to mimic the central station power plant model, which it refers to as “the existing paradigm”.

According to the CAPX2020 initiative included in the IRP, the use of distributed energy resources such as DS ". . . challenges the current capabilities of the grid and challenges the existing operation paradigm."

Instead, Xcel will need to prepare for a scale-up of community-based power that fits the capacity of each local substation, instead relying upon of high-powered transmission lines as the first order in its paradigm.

Xcel’s Integrated Resource Plan estimates and thereby proposes around 3500 MW of solar power coming from large, utility-owned solar farms by 2030. In the IRP, Xcel says that insufficient transmission capacity prevents them from adding more utility-scale renewables in the next 6 years. This constraint and the recent federal tax credit extension strengthens the case for going big on local distributed energy in the meantime--helping cities and counties meet their own goals for in-boundary electricity generation.

Utility scale solar is indeed useful in areas where there is already more than enough grid infrastructure to accommodate it, most notably Xcel’s recent proposal to add a solar farm near their Sherco site since it is already on a transmission corridor. But seeing this disparity between 275 MW of non-utility solar versus 3500 MW of Utility Solar at one point in Xcel’s IRP comes across as an intention to structure new solar in a way that would enable Xcel to maximize its market share and rate base the assets. I later learned there is part of Xcel’s IRP clarifying that any surplus of Community and Distributed Solar beyond their estimates will be subtracted from the total estimate of Utility solar so that the overall levels of solar on the system would be at the same level.

Expressing such a huge 3500 MW to 275 MW disparity on the front end at one point in the IPR process sends a worrisome message. Instead of more people or communities owning their own solar panels, Xcel’s IRP appears to be presenting to us a future where the right to profit from renewables is overwhelmingly controlled by monopoly utilities. Xcel, as a publicly traded for profit Fortune 500 company, has a better chance of maximizing its profits if it owns as much of the power generation as possible. Otherwise, it just becomes a company that maintains the grid. While the electric grid is a natural monopoly, energy generation no longer has to be.

This motive to centralize new solar generation for the purpose of maintaining market share has one big effect on the most central and controversial part of Xcel’s IRP, the Sherco Gas Plant.

FIT NEW SOLAR INTO EXISTING GRID INFRASTRUCTURE WHEN POSSIBLE

Excessive geographic consolidation of solar arrays is bad for overall solar collection. Over reliance on utility-scale solar at the explicit expense of distributed solar will limit the amount of sunlight we can collect for energy.

If a utility follows the central station model and concentrates its solar power generation into just a few geographic areas, then it will cause significant disruptions in power supply when a cloud happens to go over that one area. On the other hand, when solar generation is more distributed, it helps add improved reliability to the power supply. Having less intermittency in power supply would undercut Xcel’s justification that building the new Sherco gas plant is necessary.

But we can also consider the quality of electricity, not just the quantity. The electricity generated by community solar is particularly valuable to Xcel during summer peak load times when air-conditioning use causes huge electricity demand. This peak load time also happens to be when solar electricity generation also peaks. Without the Community Program, Minnesota would be vastly behind where we are in expanding solar generating capacity.

In 2013, before the Community Solar statute was passed into law, there was almost no solar energy production in Minnesota to today where over 700 MW are being produced by community and rooftop solar in Xcel’s Minnesota territory. Community solar is an essential way to make solar accessible for renters and low to moderate income. This value of accessibility is overall an essential part of scaling up an innovation.

The extra solar capacity saves Xcel from having to go out on the open electricity market and buying some of the electricity needed to meet that peak demand at market prices, which happen to be at their highest at peak demand times in the summer.

The Public Utilities Commission (PUC) should instead both expect and support an accelerated scale-up of community-based clean energy. There is a strong consumer interest and organized groups who are committed to making it happen. Furthermore, this approach I recommend falls in line with the PUC’s mission to protect the utility customer from being saddled with unnecessary expenses.

Rather than designing the deployment of new solar power around what is best for a utility’s market share and capital formation, a more balanced approach to resource planning would be one of strategically sizing and locating new renewable power generation to fit within the capacity that each corresponding substation can accommodate. The goal of this approach is to avoid having to construct new million-dollar-per-mile high voltage transmission lines (HVT) that would saddle Xcel Customers with preventable expenses if they could be avoided. Furthermore, adding new HVT lines could become controversial political bottlenecks in the communities they are routed through which can delay the clean energy transition to be slower than what Xcel expects in the IRP.

This is not to weigh in on separate dockets as to whether Xcel should not be allowed to build new high voltage transmission lines if specific lines are proven to be needed to make the clean energy transition. It more of a matter of Xcel being open minded toward opportunities to take this strategic approach. There is more efficiency with less transmission because neighborhood-generated energy doesn't need huge transformers and power lines.

While Xcel may earn profits off of building new HV Transmission lines and may thereby lack incentive to consider scalable alternatives, it is more infrastructure that customers will pay for via rate increases that may be bigger than necessary.

FAIR STUDIES AND MODELING AT DISTRIBUTION LEVEL NEEDED

With the above connections in mind, Xcel’s lowballed estimate for non-utility owned solar points toward a pretty strong indication where the utility has a conflict of interest. It would be within the formal role of state regulators to either require electric utilities here to model an aggressive rooftop solar and distributed energy adoption scenario or to ask for a corresponding independent analysis of their capacity expansion and infrastructure plans.

If regulators do not obligate utiliy companies to do so, then upper utility management will act from an incentive to exclude these sets of considerations from their models, assumptions, and underlying calculations in resource plan forecasts. Incumbent utility management has understandably likely hesitation against seriously studying a high rooftop solar adoption scenario due to anticipation of not liking the most probable outcome of such a study. A cited earlier 2018’s McKnight Foundation “Smarter Grid” study by GridLab showed that distributed renewables and efficiency together could save $1,200 per Minnesota household per year. https://www.mcknight.org/programs/midwest-climate-energy/mn-smarter-grid/

If Xcel is not even required to share and demonstrate their assumptions and modeling methods behind their rather low forecasts for distributed solar deployment, then that presents a problem. The PUC, if it has not already, it should demand better modeling from Xcel so that a more accurate forecast can be determined. Without any sort of transparency, how can Xcel’s resulting estimates and forecasts on this matter have any merit? Because more distributed solar could offset the need for a future fossil gas power plant, a more robust analysis of it is warranted.

For the above reasons, I’d strongly encourage that Xcel be obligated to include energy modeling at the distribution level. I have learned that Xcel is in fact doing such an Integrated Distribution Plan and that it is a fairly new concept. I had assumed it would be recognized in Xcel’s Integrated Resource Plan, but perhaps it will be in the next one. Again, would be a dishonest circular argument for Xcel to publicly downplay the potential for distributed renewable power in its IRP or make a blanket claim that the scenario is not possible if the company didn’t even do the modeling necessary that would reveal the possibility. Unless public regulators require a full and transparent assessment & exploration of how distributed generation can meet future electric grid resource needs, then they are complicit with the utility resource planning process not being in the public interest. If the PUC does not have the power to demand clearer answer from Xcel on what they are capable of with distributed solar, storage, demand response etc. is there a way how the PUC could get the company to acknowledge comparative models from other organizations?

In Fairness, here is the distributed energy page from the Department of Commerce: https://mn.gov/commerce/industries/energy/distributed-energy/ as well as their solar potential analysis from late 2018:

https://mn.gov/commerce-stat/pdfs/solar-potential-analysis-report.pdf

TRANSPARENCY ON XCEL’S AVOIDED COST FIGURES

There is another piece to the puzzle in getting the above strategy for distributed renewables and non-utility solar to be viable. Xcel should make some commitment in its IRP to publish the avoided costs for distributed generation project developers. Entrepreneurial Clean Energy project developers face a tilted playing field due to lax enforcement of federal PURPA (Public Utility Regulatory Policies Act) legislation

In principle, you can’t have market competition without a fair price. This federal law from 1978 called PURPA provides a framework for entrepreneurial third-party renewable energy project developers to receive long-term contracts to sell their energy to a utility at a fair price that reflects the full range of benefits they would provide. But that assumes the law is properly enforced by state regulators. Poor implementation of it makes it difficult for developers to get financing for distributed generation projects. PURPA technically requires utilities to publish their “avoided costs” for obtaining the new energy generation and capacity that these developers’ projects would provide to them. But monopolies are understandably reluctant to enable their potential competition either meet or beat their prices.

So, utilities have an incentive to play a game of “hide the peanut” when it comes to making these figures available for public inspection. In addition, neither the MN State Department of Commerce nor the MN Public Utilities Commission appears serious about enforcing this part of the law. As a result, utilities have managed to find a loophole get around PURPA by claiming “trade secret” when it comes to publishing the full range of benefits and avoided costs that obtaining the new distributed energy generation would provide for them.

In addition, here is the catch-22 that greatly limits the potential from distributed renewables from being realized. Xcel (and other utilities) require entrepreneurial developers of distributed renewables to get the financing to develop their projects just to be able to enter the stage of 'contract negotiation'. But private developers can’t get the financers to give the financing they need for their projects without adequate pricing data. The data the entrepreneurial developers need to get this financing would require utilities such as Xcel to publish their avoided costs. Xcel and others are able to avoid publishing these avoided costs by taking advantage of being able to claim the "trade secret" designation.

Neither the developers nor the financiers and will have an incentive to take on these projects without the expectation of receiving full compensation for the benefits they provide to the grid. The utility management will finally disclose their avoided costs figures if the proposed projects get into the contract negotiation stage as PURPA requires. But the entrepreneurial developers need financing just to get to that stage. This Catch-22 results in a tilted playing field where only large developers who already have flush cash reserves, robust lines of credit and multiple financial backstops could compete in.

In other states where utilities follow federal PURPA guidelines without hiding their avoided costs, we have seen a substantial number of solar projects generated. In North Carolina, the Energy Information Administration reported in 2016 that over 90 percent of the state's 1,200 megawatts of utility-scale solar PV projects was due to its effective implementation of existing federal law.

https://www.eia.gov/todayinenergy/detail.php?id=27632

In states like Idaho and Utah, there was significant growth in projects until the required contract length between the developers and the utilities was slashed by their state PUCs (in the case of Idaho, from 20 years to 2 years).

To maximize the amount of solar generation possible, the Minnesota PUC needs to demand that Xcel publishes their avoided costs and to require that Xcel gives long-term (20 year or more) contracts/ allotments to distributed generation developers.

To conclude, there are an abundance of outside studies and analysis showing increasingly viable alternatives to a new Sherco gas plant, which other commentators will go into a bit more detail on. I have recommended an approach of strategically sizing and citing distributed renewable generation to fit in with the existing grid system, which would be helped by Xcel publishing their avoided costs that each project would deliver. With the help of the state statue, the Public Utilities Commission has a role to hold Xcel accountable for the incentives that lead the company not to consider alternatives to Sherco Gas or the new approach which I laid out that benefits customers over shareholders.